37+ mortgage interest tax deduction 2022

Web Standard deduction rates are as follows. Homeowners can deduct what they paid in mortgage interest when they file their taxes.

Jpm Mortgage Warnings Pdf Basel Iii Securities Finance

How To Claim Mortgage Interest on Your Tax Return You must.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

. Real estate taxes on. Mortgage interest Many US. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

The deduction for mortgage insurance premiums treated as mortgage interest under section 163h3E and formerly reported on lines 10 and 16. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Expired tax benefits.

Medical expenses paid 11850 Real estate taxes on home 13250. For tax year 2022 those amounts are rising. For tax years before 2018 the interest paid on up to 1 million of acquisition.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. 12950 for tax year 2022 Married taxpayers who. Therefore the total itemized is below the standard.

However higher limitations 1 million 500000 if married. For tax year 2022 those amounts are rising. Web 5 tax deductions for homeowners 1.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Its one perk of homeownership that could save you. Payments on car lease 8875.

Web While you can manually calculate the average balance of each loan using the method prescribed by the IRS TurboTax will have the finalized worksheet available on. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web They made the following payments during 2022.

For married taxpayers filing a separate. Web Thank you for the response but the mortgage interest of 1439500 is reported as zero on schedule A line 8A. This is where communication is vital.

As always please consult with a tax advisor to. Look in your mailbox for Form 1098. Web Heres how to claim the home mortgage interest tax deduction and what to expect in the process.

Single taxpayers and married taxpayers who file separate returns. Web The problem is the bank still issues a mortgage interest statement making it look like a tax deductible item. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard.

Web Can you write off mortgage interest in 2021. Web The IRS places several limits on the amount of interest that you can deduct each year. Web Learn how to save money by claiming the home mortgage interest deduction on your taxes.

Your mortgage lender sends you. Web Is mortgage interest tax deductible. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Today the limit is 750000. Web Most homeowners can deduct all of their mortgage interest.

Web Below are a few mortgage deductions homeowners may be able to take advantage of when filing 2022 taxes. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. That means this tax year single filers and married couples filing jointly can deduct the interest on up to.

Mortgage Interest Deduction A 2022 Guide Credible

What Is The Mortgage Interest Deduction The Motley Fool

Mortgage Interest Tax Deduction What You Need To Know

424b5

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Home Mortgage Loan Interest Payments Points Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Calameo 2022 09 Ca

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

Landlords Hands Tied Over Sme Tenants Boase Cohen Collins

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

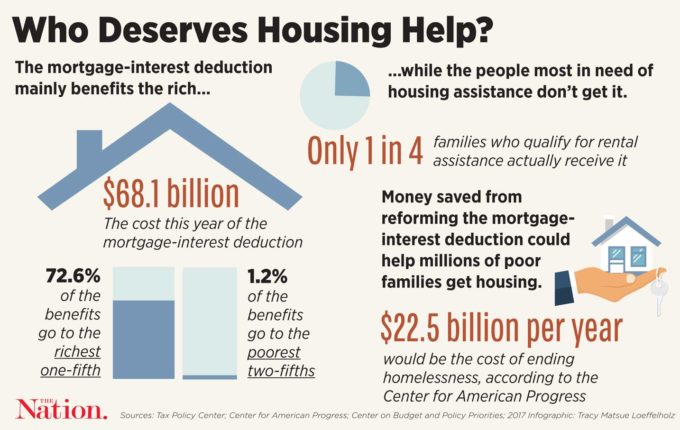

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Vystar Credit Union Review High Interest Rates On Cds

Mortgage Interest Tax Deduction What You Need To Know